The decentralized finance (DeFi) landscape has witnessed a seismic shift with the rise of Aster, a revolutionary perpetual futures exchange that has quickly dethroned long-standing market leaders. In just weeks since its token launch, Aster has not only surpassed Hyperliquid’s trading volume but has also generated more fees than industry giants like Circle and Tether.

For those new to DeFi trading, understanding the fundamentals of passive income strategies with cryptocurrency is essential before diving into advanced trading platforms like Aster.

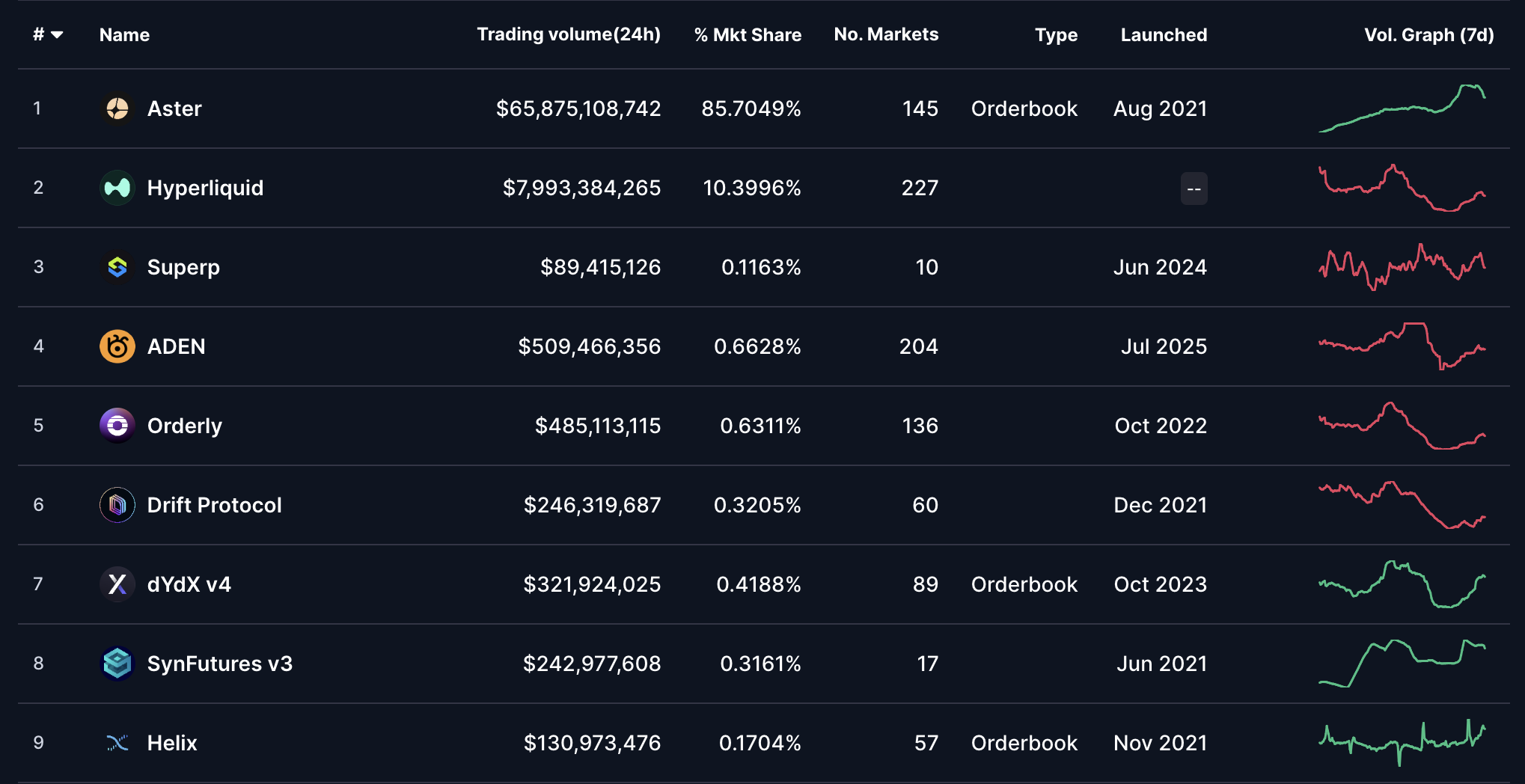

Figure 1: Aster dominates the decentralized perpetual futures market with $65.8 billion in 24-hour trading volume and 85.7% market share, significantly outperforming Hyperliquid’s $7.9 billion volume and 10.4% market share.

The Rise of Aster

Aster’s journey began in late 2024 when it consolidated two existing perpetual DEXs—ApolloX and Astherus—under a unified platform. However, the platform truly came into its own with the launch of its native ASTER token on September 17, 2025.

The token received a significant boost from Binance founder Changpeng Zhao (CZ), who publicly endorsed the project with a simple but powerful message: “Well done! Good start. Keep building!” This endorsement helped propel ASTER’s price by over 7,000% since launch, with the token currently trading around $1.93 USD and boasting a market capitalization of approximately $3.34 billion, ranking #37 among all cryptocurrencies.

Revolutionary Trading Features

Aster distinguishes itself through several innovative features that set it apart from traditional exchanges:

- 100x Leverage: Offers up to 100x leverage on both cryptocurrencies and traditional stocks

- Trade & Earn Model: Users can utilize liquid-staking tokens (like asBNB) or yield-generating stablecoins (like USDF) as collateral, enabling passive income on trading capital

- Non-Custodial Control: Traders maintain full control of their assets while accessing high-leverage trading

- 24/7 Trading: Bridges traditional finance and DeFi by allowing continuous trading settled entirely in crypto

- Aster Chain: Powered by a high-performance Layer 1 blockchain emphasizing privacy and speed

Technical Architecture and Innovation

From a technical standpoint, Aster represents a significant advancement in decentralized exchange architecture:

Smart Contract Design: The platform’s smart contracts are optimized for high-frequency trading, enabling sub-second execution times while maintaining security through multi-signature validation and automated risk management protocols.

Cross-Chain Integration: Unlike traditional DEXs that require bridging assets, Aster operates on its native blockchain while supporting seamless interaction with multiple networks, reducing transaction costs and complexity.

Liquidity Pool Mechanics: The platform employs advanced automated market maker (AMM) algorithms combined with order book functionality, providing both liquidity depth and price discovery mechanisms typically found in centralized exchanges.

Risk Management Systems: Aster implements sophisticated liquidation engines and position sizing algorithms that automatically manage risk exposure, protecting both traders and the protocol from catastrophic losses during volatile market conditions.

The platform is backed by YZi Labs, the family investment office of Binance co-founders Changpeng Zhao and Yi He, providing significant credibility and resources for continued development.

Aster vs. Hyperliquid: The New Champion

For months, Hyperliquid dominated the decentralized perpetual futures market, having successfully displaced dYdX from its throne. Market analysts like Arthur Hayes predicted continued dominance, forecasting HYPE token to grow 16x by 2028.

However, Aster’s recent performance has challenged these assumptions. Over the past seven days, Aster’s trading volume reached an impressive $228 billion—nearly triple Hyperliquid’s $80.5 billion according to DeFiLlama data.

Unprecedented Fee Generation

The surge in trading activity has translated into remarkable fee generation. Aster has generated $93.5 million in fees over the past week, surpassing Circle and most other crypto platforms. In the last 24 hours alone, Aster has even overtaken Tether to become the top fee earner, bringing in over $29 million.

This fee structure benefits multiple stakeholders:

- Liquidity providers receive protocol fees

- Stakers earn rewards from fee distribution

- Governance participants receive funding for their contributions

- ASTER token holders benefit from buyback programs

Market Implications

The rapid growth of decentralized perpetual trading has been remarkable, with the sector experiencing 10x growth in September alone. Aster’s success demonstrates the market’s appetite for innovative trading solutions that offer:

- Decentralized infrastructure without centralized intermediaries

- Competitive fee structures that reward participants

- High-performance trading with significant volume capacity

- Token-based incentives that align user interests with platform success

Current Market Position and Considerations

As of September 29, 2025, Aster’s rapid ascent has not been without controversy. The token’s explosive 7,000%+ growth has sparked discussions about potential market manipulation and concentrated holdings. However, the platform’s fundamental metrics—trading volume, fee generation, and user adoption—suggest genuine demand beyond mere speculation.

The ASTER token serves multiple functions within the ecosystem:

- Governance: Token holders can participate in platform decision-making

- Fee Payments: Used for trading fees and platform services

- Incentives: Powers airdrops and referral programs for liquidity providers

- Staking Rewards: Enables users to earn from protocol fee distribution

Looking Ahead

While Hyperliquid’s HYPE token maintains a $16 billion market capitalization compared to ASTER’s $3.34 billion valuation, Aster’s momentum suggests the competitive landscape is shifting rapidly. The platform’s ability to generate substantial fees while maintaining decentralized principles positions it as a formidable competitor in the evolving DeFi ecosystem.

There’s growing speculation about Aster’s potential expansion into broader DeFi services, which could further enhance its ecosystem and provide users with a comprehensive suite of financial services beyond trading. Such expansion would align with the platform’s mission to bridge traditional finance and DeFi.

Technical Implications for Traders and Developers

For cryptocurrency traders and DeFi developers, Aster’s technical architecture offers several advantages:

Developer Integration: The platform provides comprehensive APIs and SDKs for developers looking to integrate perpetual trading functionality into their applications, enabling the creation of sophisticated trading bots and portfolio management tools.

MEV Protection: Aster’s smart contract design includes built-in protection against maximal extractable value (MEV) attacks, ensuring fairer execution for retail traders competing against sophisticated algorithms.

For traders interested in learning more about MEV and how it affects trading, our guide on understanding MEV and building MEV bots provides comprehensive insights into this complex topic.

Gas Optimization: The Aster Chain’s optimized architecture significantly reduces gas costs compared to Ethereum-based alternatives, making high-frequency trading strategies more economically viable for smaller traders.

Composability: The platform’s modular design allows for easy integration with other DeFi protocols, enabling complex strategies that combine perpetual trading with yield farming, liquidity provision, and other DeFi activities.

For those new to DeFi trading strategies, understanding leveraged crypto trading and crypto arbitrage can provide valuable context for advanced platforms like Aster.

Market Dynamics and Future Outlook

The success of Aster highlights the dynamic nature of decentralized finance, where innovation and user adoption can quickly reshape market hierarchies. As the perpetual trading market continues to expand, platforms that can deliver superior performance, competitive fees, and strong tokenomics will likely capture significant market share.

For traders and investors, Aster represents both an opportunity and a reminder that in the fast-moving world of DeFi, today’s market leader can quickly become tomorrow’s challenger. The platform’s rapid ascent serves as a testament to the power of innovation in decentralized finance and the potential for new protocols to disrupt established markets.

The technical sophistication of Aster’s architecture, combined with its impressive trading volumes and fee generation, positions it as a potential blueprint for the next generation of decentralized exchanges. As the DeFi ecosystem continues to mature, platforms that can successfully bridge traditional finance with decentralized infrastructure will likely capture significant value and user adoption.

For traders looking to diversify their passive income strategies beyond traditional staking, consider exploring Bitcoin passive income methods or learning about crypto security best practices before engaging with high-leverage trading platforms.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Cryptocurrency trading involves significant risk, and readers should conduct their own research before making investment decisions.